Flight to spiritual delight

Naimisharanya is set to start its first helicopter ride to Ayodhya. The new development is supposed to be completed and handed over to the tourism department by the end of December 2024. It is worth mentioning that the heliport has been constructed and will start its operations in January 2025. The total cost of development of the heliport is Rs. 9 crore, with the facility to land 3 choppers together. Moreover, the government is also planning to connect Naimisharanya with other religious hotspots such as Prayagraj and Varanasi later on.

The amenities

The terminal building of the heliport will comprise a VIP sitting lounge, an ATC building, a hangar, and a parking facility. For beautification and elevating the experience, the premises will be decorated with different plants, a cafeteria, a ticket counter, and a tourism office. Moreover, a CC road will also be laid from the main road to the helipad area with lighting facilities.

Source:- Amar Ujala, 9th December, 2024

News

Private Capex likely to reach Rs. 2.5 lakh crore in FY 2025.

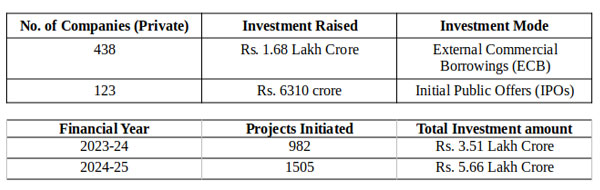

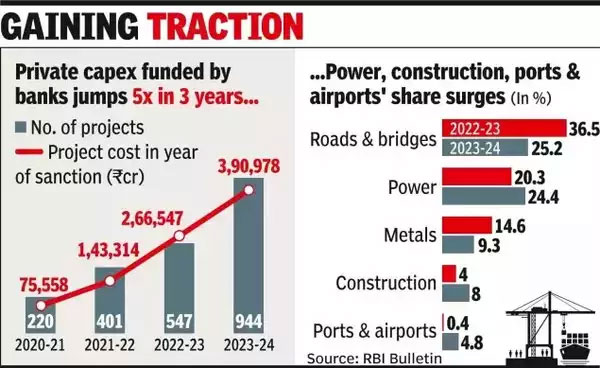

A recent study of the RBI reveals that private capital expenditure is set to make a new record with a whooping surge of 54%. Compared to last year, 2023–24, of Rs. 1.59 lakh crore, it is expected to touch Rs. 2.45 lakh crore, setting a new benchmark. For FY 2024, the cumulative cost of the projects accounts for Rs. 3.91 lakh crore. Out of this, nearly 54% of planned investments are near completion. Moreover, the total private capex intended for FY24 through various channels was recorded as Rs. 4.03 lakh crore, which is 56.6% higher than last year’s planned capex. In comparison to last year's Rs. 1.17 lakh crore current financial year, it is expected to reach Rs. 1.68 lakh crore.

The study further reveals the trend and distribution of investment patterns.

Reason for change: RBI’s study further illustrates the reason for this trend as strong domestic demand, optimistic business sentiments, government support and spending towards infrastructure development, a positive investment climate, and various other reasons.

Source:- Time of India, 21th August, 2024

News

Taxing super rich- a harakiri decisions to development

Pareto-propagated optimality criteria are indeed a great idea for policy making. However, the naive citizen with bigotry and hatred blames capitalism for inequality. It is noteworthy to mention that one cannot be made better off without making someone worse off. The rising number of super-rich in economies is often condemned for widening the rift between rich and poor. However, the progressive tax regime devised to narrow the gap seems to be more radical, as 74% of Indians support taxing the super-rich class.

Read More

News

Sensex slips amid a fake row over capital gain taxation.

A rumour of equal capital gain application on short-term and long-term gains hit the market badly, resulting in a fall in Sensex by more than 1000 points on Friday. Finance Minister Nirmala Sitaram took a stand and released a statement on social networking platform Twitter to clear the wind. The row seems over now; however, it has given a new boost to the discussion over tax abnormalities prevailing in the context of short- and long-term capital gains. Many tax consultants and specialists also expect that the government may introduce a fresh tax regime to address the concerns related to such implications. It is worth noticing that in the case of short-term gains, taxation charges are 15%, whereas for long-term gains, it is 10%. Moreover, selling securities in less than a year is considered a short-term gain, while more than a year’s duration makes it a long-term gain. In addition, several other concerns are yet to be discussed and clarified on priority.

Source:- Dainik Jagran, 5th May, 2024

RBI’s new provision pushes back the financing of under-construction infrastructure projects.

The recent guidelines of India’s apex bank, the RBI, caused a pushing-back approach to the galloping reality sector. It resulted in a downturn in shares of IREDA, REC Limited, and Power Finance Corporation on Monday. RBI’s recent mandate proposed additional provisioning against loans for under-construction infrastructure projects and strictly monitoring the projects if any irregularities in payment are found. This decision is being considered a proactive measure of RBI for the year 2012–13, in which banks sanctioned infrastructural loans on a large scale, many of which were defaulted. However, the guidelines have not been finalized yet, and asked for suggestions until June 15th to finalize the draft. As per the present guidelines, banks have been told to set a 5% additional amount of the total loan as a provision for under-construction infrastructure projects. Giving a respite in the same RBI says that upon the commencement of the project, it can be reduced to 2.5%, and on-time payment of EMIs can further reduce it to 1%. Earlier, the provisioning was 0.4%. The RBI believes that through this process, banks will be able to secure sufficient funds to run their operations.

Source:- The Economic Times (Hindi), 6th May, 2024

News

IMF positve about Asian growth, major focus on India and China

Amid the economic downturn of world economies, the International Monetary Fund boosts its growth forecast for the Asian region. The IMF recently upgraded its growth forecast by 0.3% and is expected to attain 4.5% growth. The major growth driving factor is manufacturing and real estate. India's growth rate was 6.8%, while China's was 4.6% the previous year.

Times of India, 30th April, 2024

Goldman Sachs advocates India’s successful emergence as the world's service factory.

A recent report by Goldman Sachs titled ‘India’s Rise as the Emerging Services Factory of the World' was released. It says that India’s share in global service exports has more than doubled in 18 years. Global capability centers (GECs) played an important role in achieving this significant growth. The rise of GECs offered great benefits to the real estate sector and expanded service exports. The report further illustrates the growth of high-value services that are expected to continue to grow and will lead to increased demand for commercial and residential real estate projects.

Times of India, 30th April, 2024

News

Spiritual Connect

The most ambitious project of RAV Group, “The River Castle,” takes a leap from the rest. Commemorating the spiritual journey of Lord Rama from Ayodhya to its connection with Naimisharanya, the creative was featured in the most prominent Hindi newspaper, “Dainik Jagran."

Source:- Dainik Jagran, 21th Jan, 2024

News

From struggle to creating a legacy to success, an inspirational story of RAV Group CMD, Sh. Vikram Shishodia, featured in Dainik Jagran

“When you wish something wholeheartedly, the entire universe conspires to give you that,” the golden lines of Alchemist once again proved their worth. RAV CMD’s journey is not less than a blockbuster movie where an ordinary person turns his fortune through his hard work and dedication. The prominent news paper Dainik Jagran shed some light on Sh. Mr. Vikram Shishodia’s earlier life and his future plans.

Source:- Dainik Jagran, 7th Jan, 2024

Vibrant Gujrat 2024 woos investors, bags great investment for development.

The 10th Vibrant Gujrat Global Summit is writing a new chapter in the Indian economy. The mega-investment summit not only draws investors' attention but also receives huge investment for different sectors. In a recent addition, Tata Sons chairman N. Chandrasekhran reiterated his desire to set up a huge semiconductor plant in Dholera. He further added to expand the manufacturing facility of C295 aircraft to Dholera from Vadodara. Meanwhile, CM Bhupendra Patel also said that “Gujarat aims to become a global hub for semiconductor and electronic manufacturing." It should be noted that Dholera is emerging as a manufacturing home for many MNCs. The semi-conductor and chip-based manufacturing units find it attractive to set up their production facilities. Many great billionaire industrialists, such as Mukesh Ambani (Chairman, Reliance Industries), Gautam Adani (Chairman, Adani Group), N Chandrashekhran (Chairman, Tata Sons), and Laxmi Mittal (Chairman, Arcelor Mittal Group), including Toshihiro Suzuki (President, Suzuki Motor), also showed interest in the event and said to invest in Gujrat.

Source:- aajtak.in, 10th January, 2024 Times of India, 11th January, 2024

Times of India, 11th January, 2024

News

The interim budget expectation raises high hopes for real estate.

The central government’s plan to bring the budget before the election has many crucial implications for home buyers and developers alike. Experts believe there will be a tailwind to the Indian economy if the Indian central bank further cuts down the interest rate. The Confederation of Real Estate Developers Association of India (CREDAI) also believes to have a steady REPO rate until the second quarter. In a similar fashion, the National Real Estate Development Council (NAREDCO) has also appealed to Finance Minister Smt. Nirmala Sitaraman, seeking respite in the GST tax regime, and also demanded a Rs. 50,000 crore fund. Following the trail of events, it is also believed that the government may also declare tax relaxation up to Rs. 5 lakh to boost economic growth and allure voters.

Advocating Factors:-- Government’s intention to woo more and more voters

- Steady foreign reserves

- To combat inflation caused by rising crude oil prices

- To give a boost to the demand-driven economy

- Positive indices of the Sensex

News

How India’s growth projection is a good sign for the real estate sector

Amid the global slowdown and escalating oil prices, India finally has good news. The demand-driven economy witnesses a paradigm shift and is leading the way to becoming a global leader. The recent update comes from the National Statistical Office (N.S.O.), where economic growth is projected to be as high as 7.3% in the current financial year. N.S.O.’s projection also shows stronger faith in the economy, defying the earlier projection of the RBI of 7% and higher than the previous projection of growth of 6.5%. The current fiscal year will be over by the end of March this year.

Moreover, the present growth projection is based on the performance of three major sectors, namely manufacturing, construction, and mining. However, the construction sector accounted for 10.7% of the expansion, surpassing mining at 8.1% and manufacturing at 6.5%. In addition, a strong projection of the interim budget before the Lok Sabha election and the expectation of a steady repo rate, along with raising the bar of income tax, may also fuel the growth, as per experts opinions. The estimated GDP is also expected to be 8.9%

Source:- Times of India, 6th Jan, 2024

News

Why is tech giant Foxconn very positive about Dholera?

The economic tailwind is taking a paradigm shift, and nations like India are witnessing a new dawn. All eyes are on India, and expectations are mounting. The evidence is so pervasive that it is hard to go unnoticed. At least that is what most of the global leaders and speakers believe. The most recent addition to the list is Taiwan’s largest electronics manufacturer, Foxconn’s Chairman, Young Liu. The tech giant eyes the Indian market and is overwhelmed with the prospects, which are huge opportunities.

Liu adds that it took him 30 years to build the entire supply chain in China, whereas a lesser amount of time will be required in India. His statement is an advocacy for the Make in India and Production-Linked Incentives (PLI) initiatives of the Indian Government and holds investment opportunities for tech-based manufacturing companies as well as infrastructural development companies alike. Similar to Foxconn, HP, Dell, Lenovo, and 40 other IT hardware manufacturing companies have applied for PLI. The Indian arm of Foxconn has already crossed a turnover threshold of close to USD 10 billion on an annual basis.

Since Dholera, the prominent region of Gujrat, is emerging as a potential manufacturing hub and home to various chip-based industries (semiconductors), investment in this location is gaining popularity with an assured return and high yield for investors. The construction of Dholera International Airport and the Greenfield Expressway is expected to be completed by 2024. like giant IT solution giants like CISCO and IBM, are already roped in to contribute to the development of world-class smart cities. All these portray a rosy picture of Dholera and project a great investment opportunity.

Source:- Times of India, 7th Sep, 2023.

News

India's growth trajectory is a new hope for property investment. (in context of ADB’s president’s recent statement)

In a recent edition, ADB president Masatugu Asakawa shared his views on the development of the Indian economy and trusted its growth in the coming years. This news blog is important from various perspectives, as India is the only country where demographic dividends post strong domestic demand and ward off the effects of the global slowdown. The global demand is expected to be weaker than the previous year, and no further respite can be expected by the year 2024. However, the first half of the growth of developed nations like the US and Japan might surprise most of us, but we need to understand that the initiative of interest rate hikes by the US Federal Reserve and European banks is fueling it. The growth of Asian and Pacific regions is supposed to be close to 5% this year and next year.

Moreover, the collapse of China’s property market is a clear sign of headwinds due to the domestic real estate sector and weaker global demand. Worries loom over as exporters from China are concerned over the property-induced slowdown. In the Indian context, such things can be very advantageous to enter into a new trajectory and act as a tailwind to become a $5 trillion economy at a faster pace. However, to maintain fast-paced economic growth, the role of private investment and multilateral development banks (MDBs) will be the most desired phenomena. The Indian government’s infrastructure development and ease of doing business initiatives are not only raising the bar for quality services but also ensuring a positive developmental change. In light of the above-mentioned criterion, it becomes imperative to gain insight into the global economic phenomenon and park our investment in growth-driven economies and sectors like real estate, which is poised to contribute to the growth trajectory of the Indian economy.

Source: Times of India, 8th September, 2023.

News

Uttar Pradesh outpaces Maharashtra, ranked No. 1 in attracting funds from banks and financial institutions.

Those days are numbered when U.P. was considered one of the slow-paced and tagged BIMARU states. Despite being a prominent political and cultural state, it is evident that growth is sluggish due to poor infrastructure and administration. However, those are gone things. A recent bulletin of India’s central bank confirms that U.P. is among the states that attract funds for projects from banks and financial institutions. Moreover, the report further explains that the state has secured the first position to attract funds for 2022–23. All thanks to the excellent administration and commitment of chief minister Sh. Yogi Aditynath ji for turning around the picture of the state. The report illustrates a great leap of 20% in GSDP in 2021–22. Compared to 2020–21, the GSDP was recorded at Rs. 16, 45,317 crore, which increased to Rs. 19, 74,532 crore in 2021–22. Besides, multi-dimensional poverty is also estimated to decline in the state at a faster pace among the 36 states and Union territories.

Source:- The Times Of India 20th August, 2023.

Indian real estate likely to reach $6 trillion by 2047: Report

The recent report of real estate consultant Knight Frank in association with the National Real Estate Development Council (NAREDCO) states that the Indian real estate sector is likely to touch the benchmark of $5.8 trillion by 2047.

The projection for 2023 indicates PE investment in Indian real estate is poised to reach $5.6 billion, reflecting year-on-year growth of 5.3%. The current value of real estate is estimated to be around $477 billion, contributing 7.3% of total economic output. By 2047, it will be 15.5% of the total economic output.

Source:- The Times Of India 20th August, 2023.

News

RAV organizes meet to woo the investors, receives a positive response.

RAV Group's recent investment meeting received a positive response from the investors. Bags award the Mercedes GLS for best sales performance to Mr. Tarun.

Media coverage of the U.P. Ratan award

ceremony.

RAV Group shares glimpses of the ceremony for the prestigious

U.P. Ratan Award.

News

"Try and fail, but never fail to try." CMD RAV Group speaks to the heart.

A sportsman, businessman, and lifestyle coach, Mr. Vikram Shishodia shared his thoughts on what keeps him motivated.

RAV GROUP CMD Mr. VIKRAM SHISHODIA'S INCREDIBLE SUCCESS STORY | VIKRAM SHISHODIA INTERVIEW | CNBC AWAAZ

In this inspiring interview, Mr. Vikram Shishodia, the Founder of RAV Group, shares his journey from humble beginnings to becoming one of the most successful entrepreneurs in India. He talks about the challenges he faced and how he overcame them, his business philosophy, and the key factors behind his success.

Awards

Mr. Vikram Shishodia, CMD of RAV Group, receives the UP Ratan Award

RAV Group’s CMD received the Up Ratan award organized by i-next Media for the development of Naimisharanya.

RAV CMD wins the laurel in the UP Health conclave.

Mr. Vikram Shishodia won the laurel bagged by India News in the UP Health Conclave.